News

Olivenhain Municipal Water District Bond Rating Upgraded to AAA

Fitch Ratings, a global rating agency that offers independent credit opinions, has upgraded the rating for Olivenhain Municipal Water District’s revenue bonds from “AA+” to “AAA” with a stable outlook, citing historically high liquidity, manageable borrowing plans, conservative financial forecasting, and equitable and disciplined rate-setting. AAA is the highest possible rating assigned by Fitch, and OMWD is one of only a handful of Southern California water agencies that have achieved this pinnacle of financial excellence.

Fitch noted that based on audited financials, OMWD’s financial performance remains strong even in the most difficult operating environments, including a historic drought and sharp increases in wholesale water costs. Despite the stress of drought and resulting revenue reductions due to state-mandated conservation, OMWD maintains solid cash reserves and debt coverage, which Fitch expects to continue.

“We are proud that OMWD’s conservative fiscal policies have been recognized by Fitch, as a higher bond rating will bring real savings to our customers,” stated Larry Watt, Treasurer of OMWD’s Board of Directors. “This upgrade is a testament to the well-founded board policies and principles guiding OMWD’s planning efforts.”

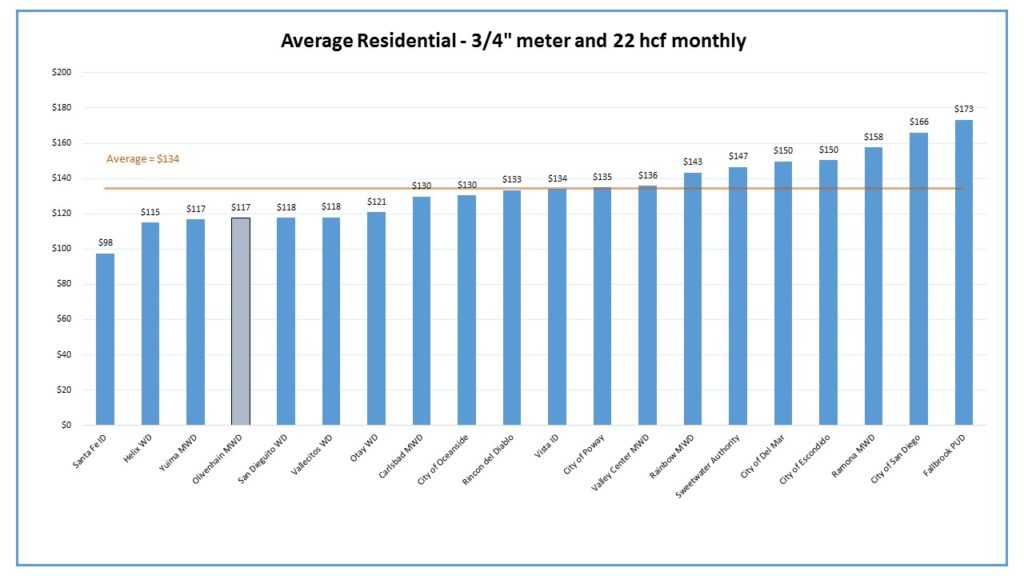

Fitch noted that OMWD’s rate structure allows management to promptly react to unexpected changes in revenue or expenditure trends. In 2015, OMWD added a fourth tier to this rate structure to supplement conservation efforts, which helped to stabilize revenue while fully complying with state reduction requirements. Despite annual water rate increases attributable primarily to increased wholesale costs, Fitch reported that OMWD rates remain affordable in the mature residential area with San Diego County’s diverse economy.

Higher bond ratings equate to a lower risk of default, so achieving an upgraded bond rating will help to alleviate the upward pressure on water rates resulting from increasing wholesale water costs. This will also afford OMWD lower interest rates when issuing bonds to finance critical new water facilities. Since the debt will be repaid over many years, any improvement in the interest rate for repayment of these bonds will result in significant savings. This protects ratepayers from bearing undue financial burden as OMWD moves forward with water supply projects designed to ensure customers enjoy reliable, high-quality water well into the future.

Fitch also praised OMWD’s water supply diversification efforts, noting these investments are positive for credit quality in the long term because they provide more reliable supplies to customers at more predictable prices. OMWD continues to aggressively expand its recycled water system and study the development of a brackish groundwater desalination facility.

Additionally, Standard & Poor’s, another major rating agency, reaffirmed OMWD’s AA+ rating with a stable outlook citing extremely strong enterprise and financial risk profiles and good management policies and practices.